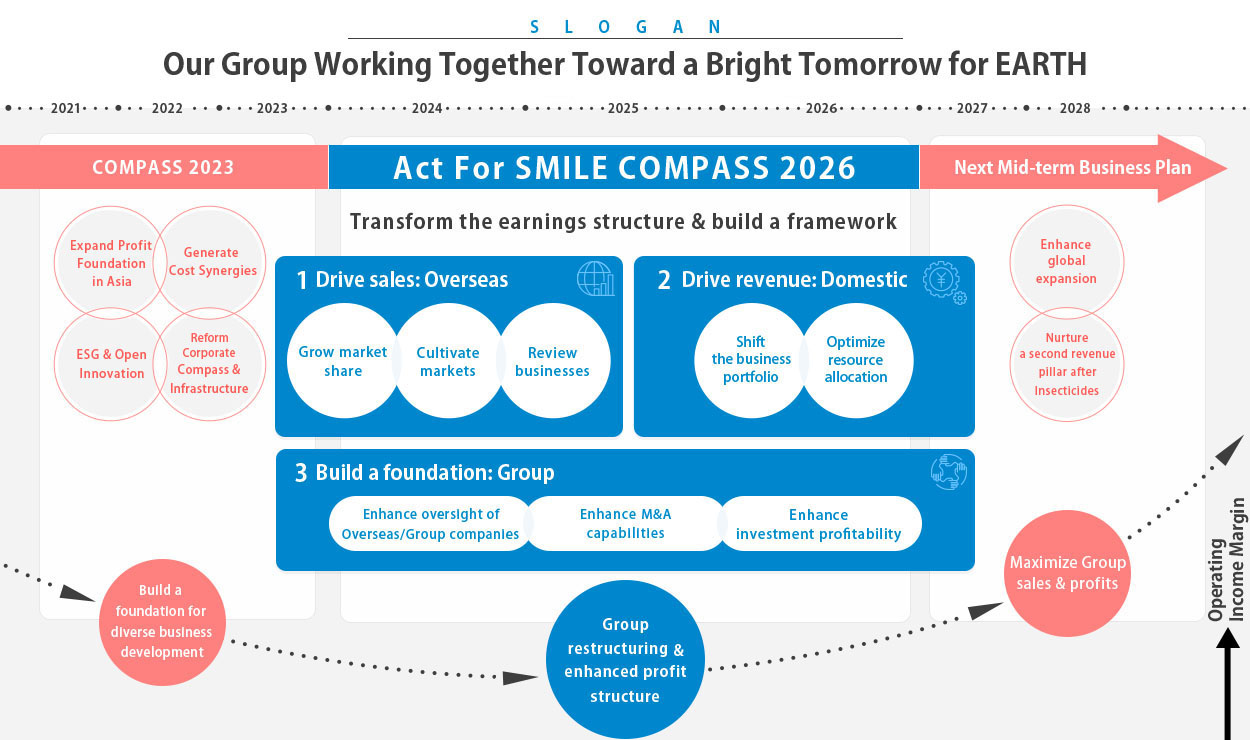

Medium-Term Business Plan

Earth Corporation has formulated a new three-year medium-term business plan, ‘Act For SMILE COMPASS 2026’, with the fiscal year ending December 2026 as the final year, with the aim of increasing corporate value. Based on a review of the previous medium-term business plan, we have identified issues and established three key policies. Under each of these key policies, we will promote various initiatives and use this period to build a foundation for growth from 2027 onwards.

Action on each focused policy

1 Expand sales overseas

- Implementing a growth strategy at each local organization

・We will implement sales strategies and measures tailored to the local situation and drive market share in each country.

・In export business, we will expand our footprint with a focus on our unique insecticides & repellents products and invest resources in highly marketable areas.

- Building a supply chain in line with Mid-term Buisiness Plan in each area

・We will establish a system for procurement, production, and logistics to ensure smooth supply in line with a product development plan.

- Expanding talent that supports growth

・We will define talent requirements for international activities and reform our human resource system for poeple working overseas.

・We will enrich global human resources through planned transfer, development, and hiring.

2 Transform the earnings structure

- "Selection and concentration" of brands/SKUs

・With future potential and profitability in mind, we will aim for improving efficiency with a target to reduce SKUs by 30%.

・We will revisit marketing investment allocation and actively invest into bath salts and oral hygiene categories.

- Improving brand value and willingness to pay

・We will redefine our brand value for customers and promote marketing to become a brand loved for many years.

・We will make improvements more accurately by re-designing brand KPIs and enhancing monitoring of communication activities.

- Lowering return rates for Insecticides & Repellents

・We will lower return rates with a target to reduce insecticides & repellents returns to zero, thus contributing to reducing environmental burden as well.

3 Enhancing group management

- Generating cost synergies through reorganization

・We will restructure and consolidate functions for optimization across the group to generate cost synergies.

- Strategic M&A

・We will position M&A as one of the tools to solve challenges at Earth Group and build a system for actively evaluating and promoting M&A.

・We will redefine an M&A longlist/shortlist and revamp PMI strategy.

- Improving profitability on investment

・We will fully monitor situations after investment and establish a better way of identifying challenges quickly and discussing how to address them.

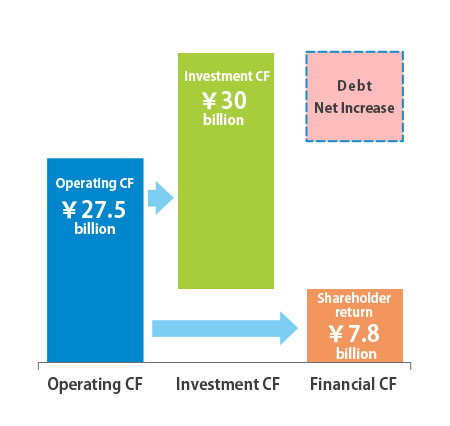

Cash Allocation

We will improve profitability and stock efficiency and increase cash generation by promoting earnings structure transformation.

| Interest-bearing debt |

|---|

| ‐ Agile approach to procuring debt when necessary |

| ‐ D/E ratio: 0.3-0.4x - ensuring a sound financial foundation |

| Investment (Approx. ¥30 billion planned) | |

|---|---|

| ‐ Structural transformation capital: ¥5-6 billion | |

| ‐ Investment in infrastructure/IT degital: ¥15 billion (¥5 billion/year) | |

| ‐ Investment in human resources: ¥1 billion | |

| ‐ Capital for the future: ¥10 billion | |

| Shareholder returns policy |

|---|

| ‐ Distribution of stable dividends aiming for a DOE target of 4% |

| ‐ Consider flexible share buyback programs |

Quantitative targets

As of 2026, the results of the structural reforms will start to become visible, but they are only a passing point, and after three years of preparation, dramatic growth will be achieved from 2027 onwards.

| 2023 results | 2024 results | YoY | 2026 target | ||

|---|---|---|---|---|---|

|

Profitability |

Consolidated Sales | ¥158.3 billion | ¥169.2 billion | + ¥10.9 billion | ¥170.0 billion |

|

Overseas Sales* |

¥17.5 billion (11.1%) |

¥21.7 billion (12.9%) |

+ ¥4.2 billion (+ 1.8pt) |

¥25.0 billion (14.7%) |

|

| Operating Income | ¥6.37 billion | ¥6.42 billion | + ¥0.05 billion | ¥7.00 billion | |

|

Operating Income Margin |

4.0% | 3.8% | - 0.2pt | 4.1% | |

| Net Income attributable to owners of parent | ¥4.1 billion | ¥3.47 billion | - ¥6.2 billion | ¥4.3 billion | |

|

Capital efficiency |

ROE | 6.3% | 5.1% | - 1.2pt | 7.2% |

| ROIC | 5.6% | 5.5% | - 0.1pt | 5.4% | |

| WACC | 4.6% | 4.7% | + 0.1pt | 4.1% | |

| Financial health | D/E ratio | 0.15x | 0.07x | - 0.08x | 0.3 - 0.4x |

| Shareholder returns | DOE | 4.0% | 3.9% | - 0.1pt | maintain 4% level |

*On a management accounting basis.Cosolidated adjustments, e.g., internal eliminations not included.

Medium-to-long-term Concept

To drive the long-term growth of Earth Group, we will solidify the group management foundation by building governance that supports international businesses and other growth fields, and restructuring organizational functions for generating synergies, thereby aiming to improve profit margins from 2027 onward.

(PDF:3,199KB)

(PDF:3,199KB)